Modern Front and Middle Office Platform Software to Launch Digital and Hybrid Digital Business Models in Wealth and Investment Management

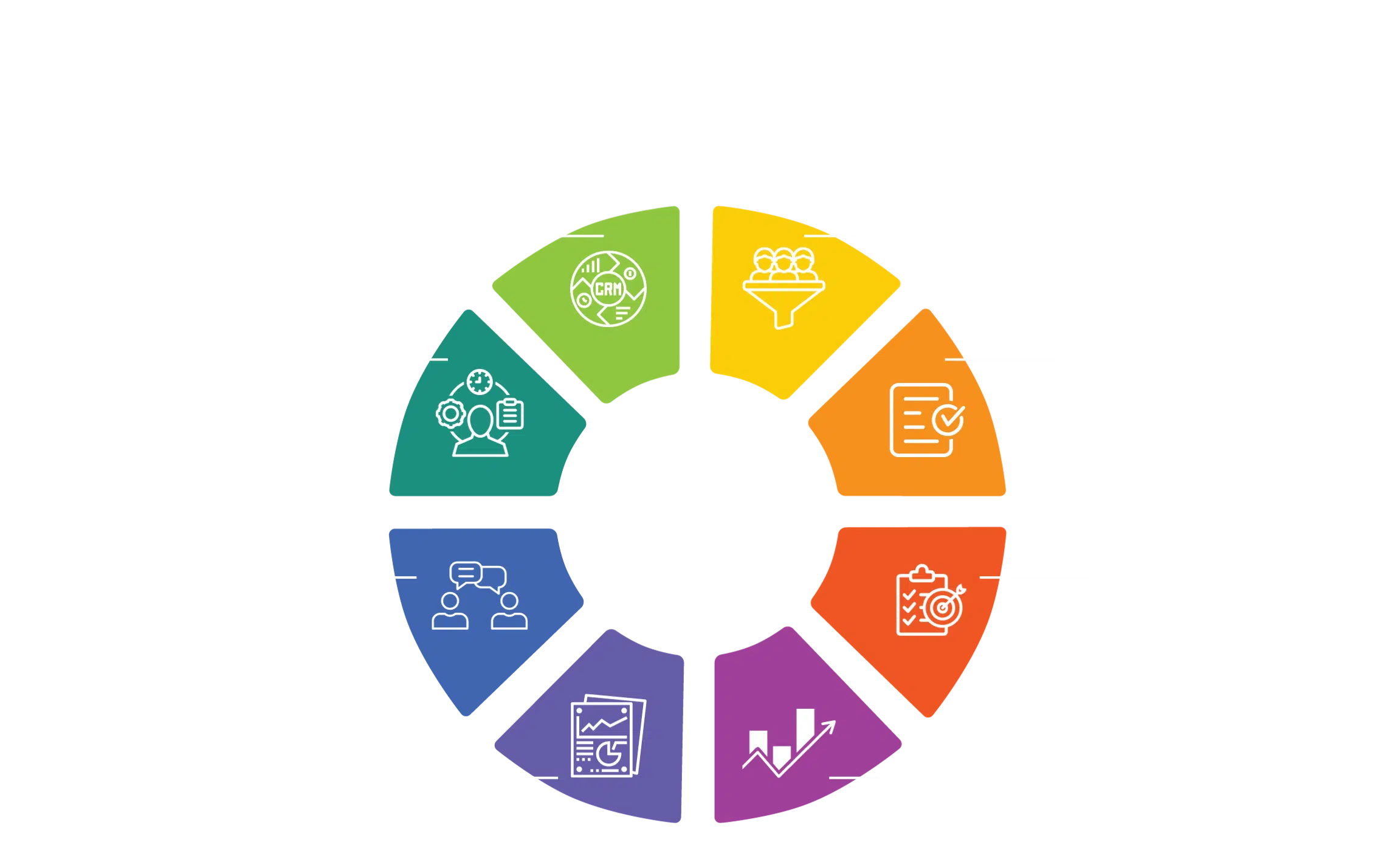

Our white-labelled SaaS Platform provides an intuitive Company-Manager Portal and an engaging Client-Investor Portal, enabling you to operate your client lifecycle management and entire business model efficiently and to deliver superior client experience in this digital age.

Includes an intuitive Company Manager Portal for all types of internal staff users to run daily business tasks and to effectively meet the client demands of the digital age

Our secure client lifecycle platform ensures that your advisers, agents, relationship managers, investment/portfolio managers, compliance and operational staff needs are met seamlessly through dedicated portals and customisable internal workflows when serving the end client.

Includes an engaging external facing Client Portal with a holistic view of client's documents, finances and communications

Our client-centric portal help firms right from client acquisition, onboarding, financial planning, investing to reporting and ongoing engagement in a holistic manner, giving them a full 360 degree view of their personal finances, secure messaging, documents, e-signatures and communications.

Able to add more digital solutions to capture new market segments quickly

We provide digital solutions across D2C Self-Directed Investing, Digital Robo Advice, Hybrid Digital Advice, Digital Retirement Planning, Modern Adviser Software and Portfolio Management Tools. We help firms stay ahead with next-generation digital business models by providing unique, engaging, and efficient digital propositions.

Modular, API-led and Cloud-native to able to integrate and work with any solution you already use

Utilising our modular RESTful API-led delivery model allows firms to bring and apply their own unique designs and experiences to the digital proposition, enabling them to differentiate from their competitors and get to the market faster.

We are your strategic partner to launch any custom digital investing and advisory proposition with our platform suite, APIs and custom solutions

We help Wealth Managers, Investment firms, Banks, Insurance companies, Brokerages, and many others in financial services to run modern investing and wealth propositions and improve their existing operations using our platform automation, innovation and engaging user experience.

Award-winning platform technology to launch any bespoke digital solution

Our award-winning technology and customisable modules enable many forward-thinking firms to support varied digital business models and prepare for the next era of savings and investments.

OUR ADD-ON solutions

Additional Solutions that can be added to our platform

All-in-one Manager and Client Portals

Intuitive & engaging digital experience

Serve clients digitally or hybrid

Ready to use the day you sign-up

Modular and secure platform technology

Grow with us with modern technology

Your branding and Unique URL options

Mobile Apps and Multi-device

Multi award winning solutions

Want to learn more?

Ready to discover more? Experience our platform for free.

We're confident it will transform how you and your clients interact.

We're confident it will transform how you and your clients interact.